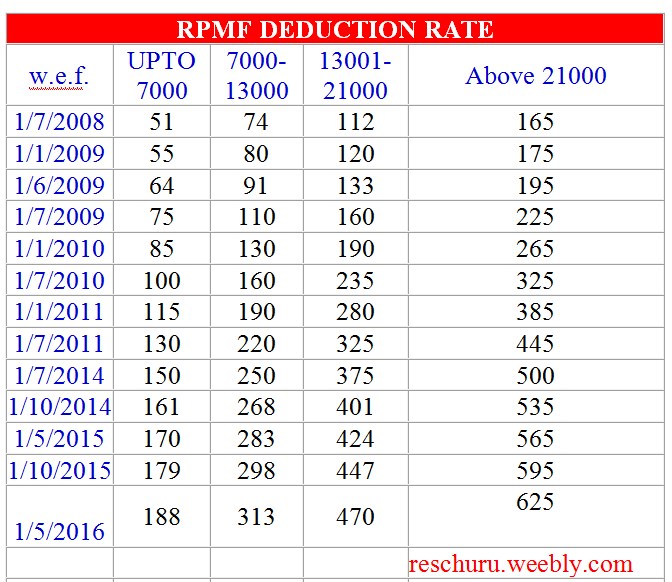

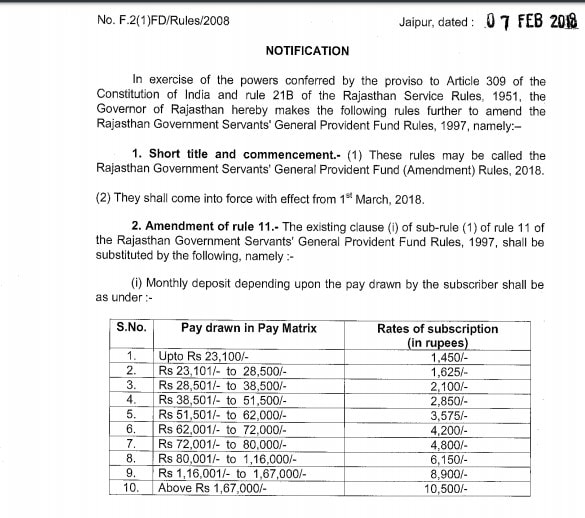

SLABS LEARNING MATERIAL ADARSH VIDYALAYA IMPORTANT LINKS Contact About SIQE. Reschuru.weebly.com gpf01-03-18.pdf: File Size: 50 kb: File Type: pdf: Download File. Gpf30-10-17.pdf: File Size: 47 kb: File Type: pdf: Download File. Powered by Create your own unique website with customizable templates. SLABS LEARNING MATERIAL ADARSH VIDYALAYA IMPORTANT LINKS. Reschuru.weebly.com rpmf.pdf: File Size: 67 kb: File Type: pdf: Download File. वेब पोर्टल पर आपका स्वागत है । welcome to our web-portal www.edujodhpur.weebly.com for suggestion whatsup number -m.pilania principal gsss udwala,churu. SLABS LEARNING MATERIAL ADARSH VIDYALAYA IMPORTANT LINKS Contact About SIQE ORDERS FAQ QUESTIONS &ANSWERS 15 AUGUST SPECIAL BOOKS PDF MOBILE APPS. Reschuru.weebly.com Powered by Create your own unique website with customizable templates.

AP Teachers Transfers 2020 Staff Pattern GO MS 53 Guidelines released.

G.O.MS.No. 53 Dated: 12-10-2020. Read the following:-

- 1. Right to Education Act 2009 read with Rules issued in 2010.

- 2. G.O.Ms.No.55 Education (Ser.III) Department, dated:23.04.2011.

- 3. G.O.Ms.No.61 Education (SE-SER-III) Department, dated: 16.05.2011.

- 4. G.O.Ms.No.29 School Education (SER.II) Department, dt.22.05.2017.

- 5. G.O.Ms.No.33 School Education (SER.II) Department, dt.04.06.2017.

- 6. G.O.Ms.No.42 School Education (SER.II) Department, dt.30.06.2017.

- 7. From the CSE, A.P., Lrs.Rc.No.36/Estt.III/2019, Dt: 08.06.2020.

Government of India have enacted the Right of Children to Free and Compulsory Education Act 2009 and Government of Andhra Pradesh have issued Rules in 2010. As per Section 19 read with the Schedule of the Act, Government have set the norms of number of teachers to be positioned from Class I to Class VIII based on the student strength.

2. Government vide G.Os 2nd and 3rd read above have issued norms for rationalization of schools, posts and staff under various managements. During the year, 2016, a Committee was constituted to study and revision of rules issued in G.Os at 2nd and 3rd read above. Based on the report, Government have issued detailed guidelines vide reference 4th read above.

3. The D.S.E., A.P., has brought to the notice of Government that the norms issued for positioning of teachers vide G.O. 4th read above were found to be in violation of RTE norms. He further informed that in the State, the schools are functioning as Primary ( Class I to V), Upper Primary ( Class I to VII) and High schools ( Class VI to X) but not as Elementary ( I to VIII ) and Secondary Schools ( Class IX to XII). The Government have framed certain norms for Primary, Upper Primary and High Schools based on the recommendation made by the Committee and that there is inconsistency between the norms of RTE and the norms framed by Government vide GO 4th read above.

4. He further informed that during the year 2019-2020, the enrollment in the Government schools increased due to implementation of Ammavodi program and further because of the thrust given by the Government for improvement of the infrastructure facilities in the Government Schools by the implementation of Nadu-Nedu Program, the enrollment is further going to increase in 2020-21.

Due to the norms framed vide G.O. 4th read above, a number of schools have become single teacher schools, which is against the norms set in by the Right to Education Act 2009. Further a number of schools were closed during the year 2017 on the ground of uneconomic strength. But the Right to Education Act has no where mentioned the minimum economic strength for a school. As per the norms of the RTE, every school that has a strength up to 60 children shall have two teachers.

6. The D.S.E., has therefore, requested the Government to issue orders for setting up of new norms for re-apportionment of teachers in super-session of the orders issued by the Govt. vide G.Os 4th to 6th read above and recommended two sets of norms to be followed for schools up to Upper Primary level and for High Schools respectively.

AP Teachers Transfers 2020 All G.O’s

7. Government after examining the matter, above and in super-session of the earlier orders issued by the Government vide G.Os 4th to 6th read above, hereby issues the guidelines for re-apportionment of teaching staff among various managements viz., Government, Zilla Parishad and Mandal Praja Parishad Schools as appended to this order. The re-apportionment of the Posts / Teachers of Government/ Zilla Parishad and Mandal Parishad Schools shall be taken up by the Director School Education duly fixing a suitable cut-off date.

8. The District Educational Officer, at district level shall prepare two statements showing the Mandal wise, School wise, students strength and the number of teachers required as per the norms appended to this order.

The Committee shall undertake the exercise of the re-apportionment of teachers. The Committee is competent to re-apportion the teacher posts / teachers in the Schools under Government / Zilla Parishad / Mandal Parishad as per the norms and guidelines issued as part of this Order.

The criteria for identification of re-apportionment of teachers shall be as follows:

a. When a post is found surplus and proposed for shifting to a teacher deficit place, those teachers who have completed 8 years of service at that particular school shall be shifted;

b. If any teacher who has not completed 8 years but happens to be a senior teacher in the school and if he/she is willing to work at the new school he/she may be shifted;

c. In case of nonavailability of (a) & (b) junior most teacher as per the service rendered in the cadre shall be shifted.

Primary School Enrollment Staff Pattern:

UP & HS School Enrollment Staff Pattern:

)

Gpf Slab.weebly.com Toilet Flapper

UP Schools being continued as Exceptional – Staff pattern (For classes VI to VIII)

Download AP GO MS NO 53 Order copy

Telangana Entrance Tests 2020

Gpf Slab.weebly.com Toilet

Income Tax Software 2017-2018 Updated for AP & TS Teachers. Income Tax for the Financial Year 2017-2018, the Assessment year 2018-2019. No change in the Income Tax slab rates and exemption limit of for individual personal in Assessment Year 2017-18 and Financial year 2016-17.

There is no change in the rate of Education cess and Secondary 2% and Higher Education Cess 1%. Housing loan principal amount exemption on Housing loan interest deduction from income tax 2015-16. Education loan and Two children Tuition fees reimbursement No Tax.Income Tax Software 2018-2019 Updated for AP & TS Teachers.

INCOME TAX 2018-2019 Slab rates:

Income Tax slab rates for the individual below 60 years for the assessment year 2017-18

- 0 to 250000 – No Tax

- 2,50,001 to 5,00,000 – 5%

- 5,00,001 to 10,00,000 20%

- 10,00,001 to and above

Income Tax Slabs For the Senior citizen 60 to 80 years for the Assesment year 2017-2018

- 0 to 3,00,000 – No Tax

- 3,00,001 to 5,00,000 – 5%

- 5,00,001 to 10,00,000 – 20%

- 10,00,001 and above

80C and 80CCE Max Exemption up to Rs.1,50,000 (savings):

Savings up to Rs.1,50,000 in PF, VPF, PPF Employee contribution in NPS, Insurance Premium, Housing loan principal repayment, NSC, ELSS, long-term bank Fixed Deposit, Post Office Term Deposit, etc. are deductible from the taxable income. There is no limit on individual items; all one lack can be invested in NSC or PPF etc.Income Tax Software 2018-2019 Updated for AP & TS Teachers.

- Pension Funds or Pension Policies Section 80 CCC.

- Infrastructure Bonds.

- NABARD rural bonds.

- Senior Citizen Savings Scheme 2004 (SCSS) Income Tax Deductions Section wise

- Provident Fund-PF & Voluntary Provident Fund-VPF.

- Postal Life Insurance-PLI

- APGLI – TGLI

- Life Insurance Premiums

- Unit-linked Insurance Plan

- Public Provident Fund-PPF

- National Savings Certificate-NSC

- Home Loan Principal Repayment & Stamp Duty and Registration

- Tuition fee for 2 children

- Equity Linked Savings Schemes

- Five(5) years bank deposits-FDS

Income Tax Deductions SECTIONS wise Details :

- For amount deposited in annuity plan of LIC or any other insurer for the pension from a fund referred to in Section 10 -23AAB-80CC

- Employee’s contribution to NPS account (maximum up to Rs 1,50,000)-80CCD(1)

- Employer’s contribution to NPS account – Maximum up to 10% of salary – 80CCD(2)

- The additional contribution to NPS – Rs.50,000 – 80CCD(1B)

- Interest Income from Savings account – Maximum up to 10,000 – 80TTA(1)

- For rent paid when HRA is not received from employer – Least of rent paid minus 10% of total income Rs.5000/- per month 25% of total income – 80GG

- Interest on education loan – interest paid for eight years – 80E

- Interest on home loan for first-time homeowners – Rs 50,000 – 80EE

- Rajiv Gandhi Equity Scheme for investments in Equities – Lower of 50% of the amount invested in equity shares or Rs 25,000 – 80CCG

- Medical Insurance Self, spouse, children Medical Insurance, Parents more than 60 years old or (from Financial Year 2015-16) uninsured parents more than 80 years old – Rs.25,000, Rs.30,000 – 80D

- Medical treatment for physically disabled dependent or payment to specified scheme for maintenance of physically handicapped dependant Disability is 40% (forty) or more but less than 80%, Disability is 80% or above – Rs.75,000, Rs.1,25,000 – 80DD

- Self-suffering from disability Individual who has a physical disability (including blindness) or mental retardation. Individual suffering from severe disability – Rs.75,000, Rs.1,25,000 – 80U

- Contribution by companies to political parties – Amount contributed (not allowed in cash) – 80GGB

- Contribution by individuals to political parties – Amount contributed (not allowed in cash) – 80GGC

- Deductions Income by way of Royalty of a Patents – Lower of Rs.3,00,000 or income received – 80RRB

Teachers INCOME TAX Softwares AP/TS FY 2017-2018 Final Updated Versions 15-2-2018- Download:

(Updated Softwares): Final Updated Versions 15-02-2018

- KSS PRASAD Sir – Software – Download

- C.RAMANJINEYULU Sir – Software – Download

- PUTTA SRINIVAS REDDY Sir – AP – Software – Download

- PUTTA SRINIVAS REDDY Sir – TS – Software – Download

- K VIJAY KUMAR Sir – AP – Software – Download

- K VIJAY KUMAR Sir – TS – Software – Download

- Perumal Ramanjineyulu Sir – Mobile Tax Software – Download

Read Also:previous years Income Tax Software 2018-19 IT returns for AP and Telangana Teachers and Employees